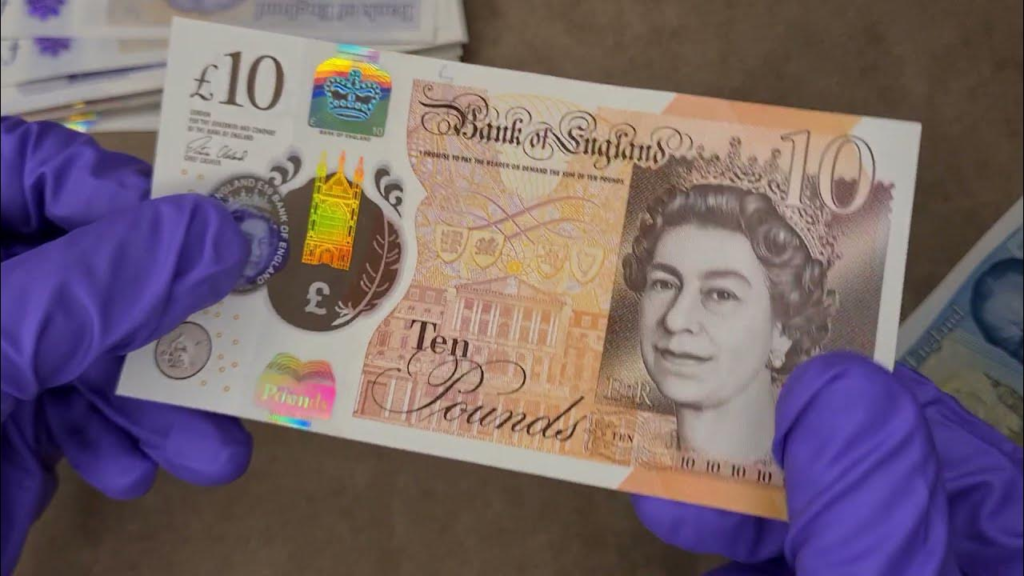

Pound rate in Pakistani rupees, The exchange rate between the British Pound (GBP) and the Pakistani Rupee (PKR) is a crucial piece of information for anyone travelling between the UK and Pakistan, or for those involved in international business or money transfers. This article delves into the intricacies of the GBP/PKR rate, addressing common questions and providing valuable insights.

Understanding the GBP/PKR Exchange Rate

The GBP/PKR exchange rate represents the value of one British Pound in Pakistani Rupees. It’s a constantly fluctuating figure influenced by various economic factors like:

Interest Rates: Higher interest rates in the UK compared to Pakistan can make the Pound more attractive to investors, driving its value up.

Inflation: Inflation in either country can erode the purchasing power of their respective currencies, causing fluctuations in the exchange rate.

Supply and Demand: If there’s a higher demand for Pounds in Pakistan, for instance, due to increased imports or travel, the Pound’s value will rise.

Global Market Conditions: Broader economic events like global recessions or political turmoil can impact currency values across the board, affecting the GBP/PKR rate.

Current GBP/PKR Exchange Rate (as of July 2nd, 2024)

At the time of writing, approximately 1 British Pound is equivalent to 352 Pakistani Rupees. However, this figure can change throughout the day and across different money exchange services.

Here are some reliable resources to get the most up-to-date GBP/PKR exchange rate:

Currency Converter Websites: Popular options include XE Currency Converter, Wise Money Transfer, and Google Finance.

Financial News Websites: Major financial news websites like Reuters and Bloomberg often display currency exchange rates.

Mobile Currency Converter Apps: Several free and paid apps like Currency Converter by XE or My Currency Converter allow you to track exchange rates on the go.

Factors to Consider When Monitoring the GBP/PKR Rate

Several factors influence how you should approach the GBP/PKR rate depending on your needs:

Travel: If you’re planning a trip to Pakistan from the UK, a higher exchange rate (more Rupees per Pound) means your Pound will stretch further in Pakistan.

Money Transfers: Sending money from the UK to Pakistan is more favorable when the exchange rate is higher in Pakistan, as you’ll be transferring a larger amount of Rupees for the same Pound amount.

Business Transactions: Businesses importing or exporting goods between the UK and Pakistan need to consider the exchange rate when calculating profit margins and pricing strategies.

Common Questions About the GBP/PKR Exchange Rate

Here are some frequently asked questions regarding the GBP/PKR exchange rate, along with helpful answers:

Will the GBP/PKR rate go up or down? Predicting future currency movements is notoriously difficult. However, by following economic news and trends in both countries, you can make more informed decisions.

Where can I get the best GBP/PKR exchange rate? Banks, currency exchange bureaus, and online money transfer services offer GBP/PKR exchange. Compare rates and fees before choosing a service provider.

Are there any hidden fees associated with currency exchange? Be cautious of hidden fees like commissions or spreads charged by money exchange services. Always ask for a transparent breakdown of all charges before finalizing a transaction.

Is it safe to exchange currency online? Reputable online money transfer services offer secure platforms for currency exchange. Look for companies with strong security measures and customer reviews.

Tips for Getting the Most Out of the GBP/PKR Exchange Rate

Here are some practical tips to maximize your benefits when dealing with the GBP/PKR exchange rate:

Shop around for the best rates: Don’t settle for the first exchange rate you see. Compare rates offered by banks, money exchange bureaus, and online money transfer services.

Look for zero-fee money transfer services: Certain online money transfer services advertise zero transaction fees, which can save you money when sending funds.

Monitor the exchange rate and time your transactions: If you’re flexible, try to exchange currency or send money when the GBP/PKR rate is favorable for your needs.

Beware of street money changers: While convenient, street money changers may offer less favorable rates and pose security risks. Opt for reputable exchange businesses.

Conclusion

Understanding the GBP/PKR exchange rate empowers you to make informed financial decisions when travelling, sending money, or conducting international business. By staying updated on the current rate, considering influencing factors, and employing these helpful tips.

FAQ’S

What is the current Pound rate in Pakistani Rupees?

As of today, July 2nd, 2024, the exchange rate is approximately 1 Pound Sterling (GBP) = 352.12 Pakistani Rupees (PKR). However, currency rates fluctuate throughout the day, so it’s best to use a reliable currency converter for the most up-to-date rate before making a transaction.

Where can I find the latest Pound to PKR exchange rate?

Several resources offer real-time currency conversion:

Mobile currency converter apps: Many banks and financial institutions offer currency converter apps for easy access on your phone.

Financial news websites: Reputable financial news websites often display currency exchange rates alongside financial news.

Why does the Pound rate fluctuate?

Several factors can influence the Pound to PKR exchange rate, including:

Supply and demand: The basic principle of economics applies to currencies as well. If there’s a high demand for Pounds compared to Rupees, the Pound rate will rise.

Interest rates: Differences in interest rates between the UK and Pakistan can affect currency exchange. Higher interest rates in the UK can attract investment, leading to a stronger Pound.

Economic performance: The overall economic health of both countries plays a role. A strong UK economy can lead to a stronger Pound against the Rupee.

Political events: Political instability or uncertainty in either country can lead to currency fluctuations.

What are some things to consider when converting Pounds to Rupees?

Transaction fees: Banks, money transfer services, and currency exchangers often charge fees for converting currency. Be sure to compare fees before finalizing your transaction.

Exchange rate variations: As mentioned earlier, currency rates fluctuate. Lock in a rate if you find a favorable one to avoid potential losses due to rate changes.

Transfer methods: Different methods (bank transfer, money transfer service) may have varying processing times and fees. Choose the option that best suits your needs.

Is it better to convert Pounds to Rupees in Pakistan or the UK?

There’s no one-size-fits-all answer. Generally, it’s cheaper to convert at a bank in Pakistan with your Pakistani debit card. However, compare rates and fees offered by banks in both countries and money transfer services for the best deal.

Are there any online money transfer services for sending Pounds to Pakistan?

Yes, several online money transfer services specialize in international money transfers. Popular options include Wise, WorldRemit, Remitly, and CurrencyFair. These services generally offer competitive exchange rates and lower fees compared to traditional banks.

What are some helpful tips for getting the best Pound to PKR exchange rate?

Shop around: Compare exchange rates and fees offered by different banks, money transfer services, and currency exchangers before converting your money.

Monitor exchange rates: Keep an eye on currency fluctuations to identify favorable times to convert.

Consider larger transactions: Some services offer better rates for larger conversion amounts.

Look for promotions: Banks and money transfer services may occasionally offer special promotions with better exchange rates.

I’m planning a trip to Pakistan. Should I exchange Pounds to Rupees before I go?

There’s no right or wrong answer. Here are some factors to consider:

Convenience: Carrying Rupees can be convenient for immediate needs upon arrival.

Exchange rates: Converting a larger amount beforehand might secure a better rate, but you risk unfavorable fluctuations.

Debit/Credit cards: Many ATMs in Pakistan accept international debit and credit cards for withdrawals, often with a foreign transaction fee.

Are there any hidden charges to be aware of when converting Pounds to Rupees?

Be cautious of the following:

Commission fees: Banks and money transfer services may charge a commission fee for the conversion.

Margin fees: Some currency exchangers add a margin to the exchange rate, making it less favorable.

Foreign transaction fees: Using your debit or credit card abroad may incur a foreign transaction fee.

To read more, Click here