Sar to Pounds, The Saudi Riyal (SAR) is the official currency of Saudi Arabia, a nation known for its rich history, vibrant culture, and booming economy. For travelers visiting this fascinating kingdom or for those engaged in international trade, understanding the conversion rate between SAR and British Pounds (GBP) is crucial. This article delves into everything you need to know about SAR to GBP conversion, from the current exchange rate to historical trends and helpful conversion tips.

Understanding Currency Exchange: The Basics of SAR and GBP

Currencies fluctuate in value against each other due to various economic factors like interest rates, inflation, and global market conditions. The exchange rate between SAR and GBP reflects how many British Pounds you’ll receive for a specific amount of Saudi Riyals.

Here’s a quick breakdown of the two currencies:

Saudi Riyal (SAR): The Riyal is pegged to the US Dollar (USD) with a fixed exchange rate. This means the value of the Riyal remains relatively stable against the USD. Saudi Arabia’s oil exports significantly influence the SAR’s value.

British Pound (GBP): The Pound Sterling is a major global reserve currency and is subject to market fluctuations based on various economic factors within the UK and globally.

Current Exchange Rate (as of June 30, 2024):

Approximately 1 Saudi Riyal (SAR) is equivalent to 0.21 Pounds Sterling (GBP). This means for every 100 SAR, you would receive around 21 GBP.

Volatility and Historical Trends:

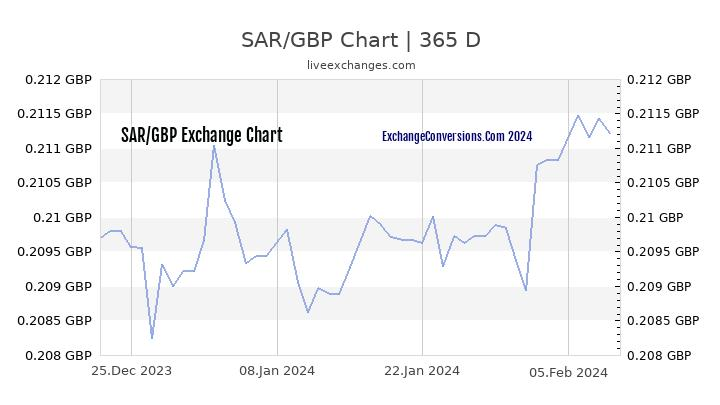

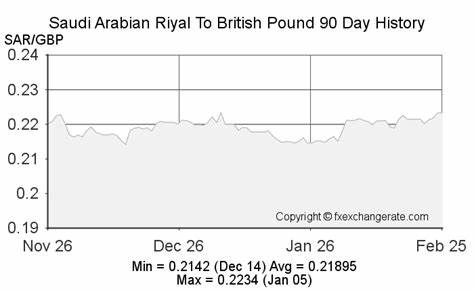

The SAR-GBP exchange rate, although less volatile than some other currency pairs, can fluctuate slightly over time. Here’s a glimpse into historical trends:

Short-term: Over the past 30 days, the SAR-GBP rate has seen a high of 0.2112 and a low of 0.2081 [Source: Wise].

Long-term: Looking at the past 90 days, the high was 0.2159 and the low was 0.2081 [Source: Wise].

Where to Find the Latest Exchange Rates?

Several online resources provide real-time and historical currency exchange rates. Here are a few popular options:

Google Search: Simply type “SAR to GBP” in the Google search bar for an instant conversion rate.

Currency Converter Websites: Websites like XE Currency Converter and Wise offer user-friendly interfaces for currency conversions.

Financial Apps: Many mobile banking and financial apps have built-in currency converter functions.

Planning Your Trip: Converting SAR for Travelers

If you’re planning a trip to Saudi Arabia, converting some of your currency to SAR beforehand is a good idea. Here are some tips to ensure a smooth conversion process:

Research Exchange Rates: Before your trip, familiarize yourself with the current SAR-GBP exchange rate. This helps you budget effectively and avoid being surprised by unfavorable rates.

Compare Rates: Don’t settle for the first exchange rate you find. Compare rates offered by different banks, exchange bureaus, and airports to get the best deal.

Beware of Hidden Fees: Some money changers may charge hidden fees like commission or administration costs. Be sure to ask about all applicable charges before finalizing your transaction.

Consider Traveler’s Checks: While less common these days, traveler’s checks can be a secure way to carry some SAR, especially if you’re venturing outside major cities.

Debit Cards: Using your debit card for ATM withdrawals in Saudi Arabia is often convenient. However, check with your bank beforehand regarding potential foreign transaction fees.

Popular Places to Exchange Currency in Saudi Arabia:

Banks: Major banks in Saudi Arabia offer currency exchange services, but their rates may not be the most competitive.

Exchange Bureaus: Licensed exchange bureaus are widely available in airports, malls, and tourist areas. They generally offer better rates than banks.

Airports: Currency exchange booths at airports provide convenience but often have less favorable rates.

SAR to GBP for International Trade

The SAR-GBP exchange rate plays a crucial role in international trade between Saudi Arabia and the UK. Here’s how it impacts businesses:

Import/Export Costs: For Saudi businesses importing goods from the UK, a stronger GBP translates to higher import costs in SAR. Conversely, a weaker GBP makes imports cheaper. For UK businesses exporting to Saudi Arabia, a stronger GBP translates to higher profits, while a weaker GBP means lower profits.

FAQ’S

What is the Exchange Rate for SAR to GBP?

The exchange rate fluctuates, but as of today, June 30, 2024, roughly 1 SAR is equivalent to 0.21 GBP. This means for every 1 Saudi Riyal, you’ll get around 0.21 British Pounds.

Where can I find the Latest Exchange Rate?

Several reliable resources offer up-to-date exchange rates. Here are a few popular options:

Currency Converter Websites: Sites like Google Finance, XE Currency Converter, or Wise offer real-time exchange rates and conversion tools [Search Currency Converter Online].

Financial Apps: Many banks and financial institutions have mobile apps that display currency exchange rates.

Travel Apps: Travel apps often include currency conversion features for easy reference on the go.

Do Exchange Rates Change Often?

Yes, exchange rates fluctuate constantly based on global economic factors like interest rates, inflation, and supply and demand. While the changes might be small day-to-day, they can accumulate over time.

What Affects the SAR to GBP Exchange Rate?

Several factors influence the SAR to GBP exchange rate:

Oil Prices: Saudi Arabia’s economy is heavily reliant on oil exports. When oil prices rise, the demand for SAR typically increases, strengthening its value against the Pound.

Interest Rates: If Saudi Arabia raises its interest rates compared to the UK, investors might be drawn to SAR-denominated assets, boosting its value.

Economic Stability: Political and economic stability in both countries can impact the exchange rate. A strong Saudi economy can lead to a stronger SAR.

Supply and Demand: Basic economic principles apply. If there’s a sudden surge in demand for SAR, its value might rise against the Pound.

Is There a “Best” Time to Exchange SAR for GBP?

Unfortunately, predicting the future of exchange rates is nearly impossible. However, you can monitor the trends and exchange when the rate seems favorable. Some resources offer exchange rate alerts to notify you when the rate reaches a desired level.

What are My Options for Converting SAR to GBP?

Here are the most common ways to convert your SAR to GBP:

Banks: Most banks offer currency exchange services, but their rates might not be the most competitive.

Currency Exchange Bureaus: These specialized kiosks offer currency exchange, often with faster service than banks, but rates might vary.

Online Money Transfer Services: Services like Wise or Revolut provide competitive exchange rates and often lower fees compared to traditional methods.

What to Consider When Choosing a Conversion Method?

Exchange Rate: Compare rates offered by different providers to get the most bang for your buck.

Fees: Be mindful of any transaction fees associated with the conversion method.

Convenience: Consider how quickly you need the GBP and choose a method that fits your timeframe.

Are There Any Additional Costs Besides the Exchange Rate?

Yes, some services might charge transaction fees, commission fees, or margin fees on top of the exchange rate. Be sure to inquire about all associated costs before finalizing your conversion.

Tips for Getting the Best Exchange Rate:

Shop Around: Compare rates from different banks, bureaus, and online services.

Consider Larger Amounts: Some providers offer better rates for exchanging larger sums of money.

Look for Deals: Banks and online services sometimes offer promotions with lower fees or better rates.

Avoid Airport Currency Exchange: These are known for offering less favorable rates due to convenience factors.

Traveling to the UK? Here are some Bonus Tips!

Notify Your Bank: Inform your bank about your travel plans to avoid having your card blocked for suspicious activity abroad.

Consider a Travel Card: Prepaid travel cards can be a convenient way to manage your spending while traveling.

Be Wary of Scams: Unfortunately, currency exchange scams exist. Stick to reputable providers and be cautious of unsolicited offers.

To read more, Click here