CHF to Pounds, The exchange rate between the Swiss Franc (CHF) and the British Pound (GBP) is a dynamic figure constantly influenced by global economic factors. Whether you’re planning a trip to Switzerland, sending money abroad, or simply curious about the financial landscape, understanding this conversion rate is crucial. This article delves into everything you need to know about CHF to GBP conversion, addressing common questions and providing valuable insights.

Decoding the Currency Jargon: CHF and GBP Explained

Swiss Franc (CHF): The official currency of Switzerland and Liechtenstein, the Swiss Franc is known for its stability and strength. It’s a popular reserve currency due to its low inflation rates and political neutrality.

British Pound (GBP): The official currency of the United Kingdom and its overseas territories, the British Pound is a major global currency. Its value is influenced by factors like the UK’s economic performance and global market sentiment towards the Eurozone.

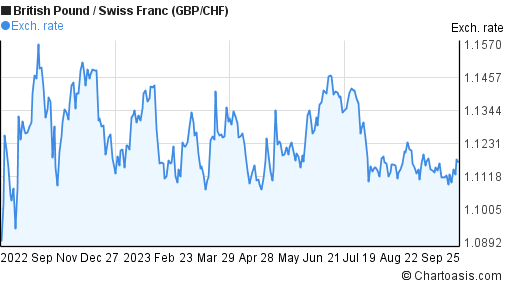

Understanding the Current Exchange Rate (as of July 2nd, 2024)

Currently, one Swiss Franc (CHF) is roughly equivalent to 0.87-0.88 British Pounds (GBP). This means that for every CHF you have, you’ll receive around 0.87-0.88 GBP. It’s important to note that this rate fluctuates throughout the day and can vary depending on the exchange service you use.

Factors Affecting the CHF to GBP Exchange Rate

Several factors influence the CHF to GBP exchange rate, making it a complex dance of global forces:

Interest Rates: Central bank interest rates in Switzerland and the UK significantly impact the exchange rate. Higher interest rates in Switzerland typically make the CHF stronger compared to the GBP, and vice versa.

Inflation: Inflation rates in both countries play a role. Higher inflation in the UK compared to Switzerland would weaken the GBP relative to the CHF.

Economic Performance: The overall economic health of Switzerland and the UK influences the exchange rate. Strong economic performance in Switzerland can strengthen the CHF compared to the GBP.

Political Events: Political instability or major events in either country can cause fluctuations in the exchange rate.

Supply and Demand: The global demand for each currency plays a role. Increased demand for CHF as a safe-haven asset can strengthen it against the GBP.

Where to Find the Latest Exchange Rates

Staying informed about the latest CHF to GBP exchange rate is essential for making informed financial decisions. Here are some reliable sources:

Financial Websites: Major financial websites like Google Finance, Yahoo Finance, and Bloomberg provide real-time exchange rate updates.

Currency Converter Apps: Several mobile apps, like XE Currency and Currency Converter by WorldRemit, offer convenient currency conversion tools with live rates.

Banks and Money Transfer Services: Banks and money transfer services typically have their own exchange rates, which may differ slightly from market rates.

Common Questions About CHF to GBP Conversion

Here are some frequently asked questions regarding CHF to GBP conversion:

What are the fees associated with converting CHF to GBP?

Banks and money transfer services typically charge fees for currency conversion. These fees can vary depending on the amount being converted and the service provider. It’s crucial to compare fees before choosing an exchange service.

Is it safe to convert CHF to GBP online?

Several reputable online currency exchange services offer secure platforms for conversion. However, ensure the service is licensed and regulated by a financial authority for added security.

Beyond the Basics: Advanced Considerations for CHF to GBP Conversion

For those dealing with larger sums or frequent conversions, here are some additional considerations:

Mid-Market Rate: The mid-market rate is the average exchange rate between the buying and selling prices of a currency pair. This is often considered the “true” exchange rate, and some currency converter apps may display both the mid-market rate and the rate they offer.

Foreign Exchange (Forex) Trading: Experienced investors can participate in the Forex market to potentially benefit from fluctuations in the CHF to GBP exchange rate. However, Forex trading carries significant risks.

Conclusion: Navigating the CHF to GBP Exchange with Confidence

Understanding the factors influencing the CHF to GBP exchange rate empowers you to make informed financial decisions when converting between these two currencies. By staying informed about the latest rates and utilizing reliable exchange services, you can navigate currency conversions with confidence.

FAQ’S

What is the current exchange rate for CHF to GBP?

As of today, July 2nd, 2024, the exchange rate is around 0.88 GBP per 1 CHF. This means that for every 1 Swiss Franc, you’ll get roughly 0.88 British Pounds. However, currency exchange rates fluctuate constantly, so it’s wise to check for the latest rate before making a conversion.

Where can I find the latest CHF to GBP exchange rate?

Several online resources offer up-to-date currency exchange rates. Here are a few popular options:

Currency converter websites: Popular choices include [Google Finance], [XE Currency Converter], and [Wise Currency Converter]. These websites allow you to input the amount you want to convert and see the equivalent amount in the desired currency.

Financial institution websites: Many banks and credit unions offer currency converter tools on their websites.

Mobile currency converter apps: Download a currency converter app on your phone for on-the-go exchange rate checks.

How often does the exchange rate change?

Exchange rates can fluctuate throughout the day based on global economic factors, interest rates, and supply and demand. While the changes might be small within a day, they can accumulate over time.

Is there a way to predict future exchange rates?

Unfortunately, predicting future exchange rates with certainty is impossible. However, staying informed about global economic news and trends can help you make educated guesses about potential fluctuations.

What are some things to consider when converting CHF to GBP?

Transaction fees: When exchanging currency, there are often fees involved. These fees can vary depending on the exchange service you use (bank, currency exchange office, online platform). Be sure to compare fees before finalizing your transaction.

Exchange rate margins: Some exchange services apply a margin to the exchange rate, meaning you’ll receive a slightly lower rate than the interbank rate (the rate at which banks trade currencies with each other).

Transfer times: The time it takes to receive your converted funds can vary depending on the service you use. Bank transfers typically take longer than online currency converter services.

What are the different ways to convert CHF to GBP?

Here are some common methods for converting CHF to GBP:

Banks and credit unions: Many banks and credit unions offer currency exchange services. However, their rates and fees might not be the most competitive.

Currency exchange offices: These physical locations specialize in currency exchange. Rates and fees can vary depending on the location.

Online currency converter services: Platforms like Wise and XE offer competitive exchange rates and lower fees compared to traditional methods. However, transfer times may be slightly longer.

Peer-to-peer (P2P) currency exchange services: These platforms connect individuals who want to exchange currencies directly. While fees can be lower, these services might involve more complexity and potential risks.

What is the best way to convert CHF to GBP?

The “best” way depends on your priorities. If you prioritize convenience, a bank or currency exchange office might be suitable. However, if you’re looking for the most competitive rates and lower fees, online currency converter services are a good option.

Are there any additional tips for converting CHF to GBP?

Shop around: Compare rates and fees from different providers before choosing an exchange service.

Consider the amount you’re converting: Exchange rates and fees might be more favorable for larger amounts.

Plan ahead: If you’re traveling, it’s wise to exchange some currency before your trip in case you need cash upon arrival.

Be wary of scams: Only use reputable exchange services to avoid fraudulent activity.

To read more, Click here